Category Archives: legislation

Phone Banking: Occupy Bernal negotiates on behalf of homeowners

We are phone banking on Wednesday. July 18, from 6-9 p.m. at ACCE, 1717 17th Street in order to identify more homeowners who have loans with Wells Fargo who would like to participate in the negotiations Wells Fargo is having with Occupy Bernal, Occupy Noe and ACCE.

Please come and help out. There will be a limited amount of Pizza and salad.

Please let Deborah G. know if you’ll come. (415) 550 1030

Below is the letter we are using to reach homeowners with Wells Fargo loans.

If you are a homeowner with a Wells Fargo loan and want to be part of the negotiations, please read the letter below for the qualifying information you’ll need to have, then contact us to see if it will be possible to be included in this round of negotiations. Please see the letter below for the appropriate contact information.

July 2012 WELLS FARGO will negotiate with homeowners

Dear Neighbor and Homeowner,

After more than six months of struggle: emails, phone calls, requests for modifications, protests at the auction of our neighbors’ homes, a unanimous resolutions from the San Francisco Board of supervisors and most recently, the passage of the HOME OWNERS BILL OF RIGHTS by the California Legislature, WELLS FARGO has entered a negotiation process with representatives of Occupy Bernal, ACCE and Occupy Noe.

We now have the opportunity to represent more Wells Fargo loan holders. This process allows Occupy Bernal and ACCE negotiators to advocate for your home, and makes a fair settlement of your situation more likely. Please join your neighbors in waging a unified and well planned struggle to achieve homeowner justice.

To be part of these negotiations—and any potential settlement– Wells Fargo demands and Occupy Bernal and/or ACCE agrees to deliver:

- PROPERTY IDENTIFICATION: Name, address, phone number, loan number and email.

- FINANCIAL PACKAGE—Complete and up-do-date. Please check with OB or Ed Donaldson for completeness.

- SIGNED 3rd PARTY AUTHORIZATION, specifically naming any SF ACCE, Occupy Bernal or Occupy Noe negotiators.

If you have a Wells Fargo loan, this is an overdue and important opportunity to get real satisfaction. And be assured: no modifications, or other payments will be finalized without your full knowledge and consent.

To join this negotiation process, call or email:

- Buck B. (415) 385-0389 BuckB@devinegong.com

- Deborah G. (415) 550-1030 dgerson646@gmail.com

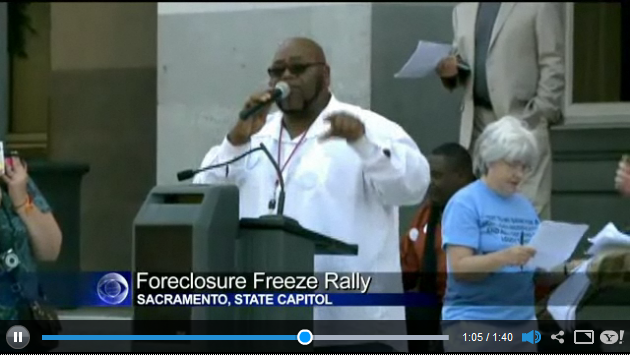

Occupy Bernal Foreclosure and Eviction Fighter Ross Rhodes at Sacramento Foreclosure Moratorium Rally

Mainstream media caught on camera our very own Foreclosure and Eviction Fighter Ross Rhodes speaking at a Foreclosure Moratorium Rally in Sacramento on June 25, 2012.

Several other Occupy Bernal members attended the rally and lobbying day in support of the Homeowner Bill of Rights and some facilitated a teach-in on foreclosures and activism.

Mayors’ Pause Letter

June 6, 2012

Mr. James Dimon

JPMorgan Chase & Company

President and Chief Executive Officer

270 Park Ave

New York, NY 10017

Dear Mr. Dimon:

We are writing to you and the CEOs of the nation’s four other mortgage loan servicers that

settled in the joint federal-state mortgage settlement to ask that your company pause foreclosure proceedings against eligible borrowers until the settlement is finalized and the monitoring mechanisms are fully in place.

As the terms of this landmark agreement evolve from language into action, our residents deserve interim protections until the monitoring administrators are fully in place. After years of uncertainty, California’s homeowners need the opportunity to participate under the terms of the federal-state settlement agreement that is just months away from being available. A temporary pause in foreclosures against only eligible borrowers would provide this relief.

Over the next six to nine months, the settlement administrator, attorneys general, your company and the other mortgage servicers – Bank of America Corporation, Wells Fargo & Company, Citigroup Inc., and Ally Financial Inc. – will work to identify homeowners eligible for the immediate cash payments, principal reductions, short sales, and refinancing. Those borrowers who are eligible will receive letters informing them of next steps.

While this process unfolds, we are asking your company to pause foreclosure proceedings against borrowers who could receive a letter in the future informing them of their eligibility for relief as outlined in Exhibit D of the five lenders’ consent judgments. The settlement is targeted toward homeowners who could remain in their homes if a principal reduction or refinancing option were available to make their loan more affordable. Some of those homeowners you agreed to evaluate are currently delinquent on their mortgages, while others are underwater but current on their mortgages. We believe the settlement’s specific eligibility requirements adequately constrain the pause such that borrowers must continue to make payments, or risk losing protection from this temporary halt in foreclosures.

Unfortunately, the California cities we represent are at the center of our nation’s foreclosure crisis. The residents of our state, who California State Attorney General Kamala Harris represented at the bargaining table, deserve the opportunity to participate in the terms of the agreement for which her office advocated and to which your company agreed. This includes:

• Providing a minimum of $12 billion in principal reductions on loans or offering short sales to approximately 250,000 California homeowners who are underwater on their loans and behind – or almost behind – in their payments.

• Refinancing the loans of 28,000 homeowners who are current on their payments but underwater on their loans using an estimated $849 million of the refinance program.

• Receiving assistance from the $1.1 billion estimated to be distributed to homeowners for unemployed payment forbearance and transition assistance, as well as to communities to repair the blight and devastation left by approximately 16,000 recent foreclosures. Vacant homes would not be included in the pause, as we can all agree that it is in the best interest of the neighborhood those homes are located in, their city and our economy in general for those homes to return to market as quickly as possible.

• Monitoring by UC Irvine law professor Katherine Porter, a noted specialist in foreclosures and bankruptcy, with an agreement that allows Attorney General Harris to enforce the penalty provisions in California state court.

As your servicing staff know well, distressed borrowers are very difficult to reach. The pause will allow our cities the time to partner with your servicing staff, the Attorney General’s office, and local HUD-certified counseling agencies to plan a comprehensive communication and outreach strategy to identify eligible borrowers and inform them of their rights under the settlement. As a result, we believe borrowers will be more informed of their rights, more organized with their financial documentation, more willing to stick through the process of having their loan evaluated for modification, and ultimately, more likely to receive relief under the settlement.

Thank you for your consideration of this request.

Sincerely,

Mayor Edwin Lee, San Francisco

Mayor Chuck Reed, San Jose

Mayor Kevin Johnson, Sacramento

Mayor Jean Quan, Oakland

Mayor Ashley Swearengin, Fresno

Phil Ting: Stand Up for the Homeowner Bill of Rights

Sign the petition today.

It’s common sense that big banks and other lenders should need to prove they are owed the debt on the home – before they foreclose on a family. It might be common sense, but unfortunately, it is not California law. Please sign the petition today to support the Homeowner Bill of Rights.

The Facts on Foreclosure

Earlier in the year, I released data from California’s first in-depth look at problems with foreclosure documents. The audit released by my office showed pervasive problems with foreclosure documents. Our audit, which gained national attention, found that nearly 60% of documents were backdated in some fashion and fully 84% of documents contained at least one legal flaw.

That shocking fact is that in California families today face foreclosure despite the flaws in mortgage records so severe that the title is in question.

We all know the costs of the foreclosure epidemic – trillions of dollars in family assets whipped away after a decade of lending speculation. Nearly every reputable economist agrees: the continuing high rates of foreclosures are delaying full economic recovery, meaning they contribute to high unemployment and lower state tax revenues – which in turn trigger cuts to vital program like education.

There are so many things our state needs to do to get back on track. But restoring common sense and justice to our housing markets and foreclosure process is one of the first things we should do – because helping to avoid unnecessary and even unlawful foreclosures is a powerful economic stimulus.

Protecting California Homeowners from Foreclosures

The package of legislation, now commonly-referred to as the Homeowner Bill of Rights, would create long-overdue protections like requiring creditors to provide documentation to a borrower that establishes the creditor’s right to foreclose, prohibiting creditors from recording a notice of default when a timely-filed application for a loan modification or other loss mitigation measure is pending, and requiring creditors to provide a single point of contact to borrowers in the foreclosure process.

Common sense, right?

Let’s help Attorney General Harris, Senate Pro-Tem Darrell Steinberg, our own State Senator Mark Leno, State Senators Fran Pavley and Mark DeSaulnier, Assemblyman Mike Eng, Assemblyman Mike Davis, Assemblywoman Wilmer Carter, and other leaders in Sacramento pass this important package of reform to help avoid unnecessary and unlawful California foreclosures.

San Francisco Board of Supervisors Unanimously Passes Foreclosure Moratorium Resolution

The San Francisco Board of Supervisors on April 10 voted unanimously to pass a resolution calling for “support for state and federal measures to protect homeowners and suspension of foreclosure activities in San Francisco”. The resolution supports the Homeowner Bill of Rights legislation before the state legislature and urges city and county officials and departments to protect homeowners from unlawful foreclosures. The resolution also urges all mortgage and banking institutions to suspend foreclosure activities and related auctions and evictions until state and federal measures to protect homeowners from unfair and unlawful practices, as well as provisions for principal reductions, are in place.

Supervisor John Avalos proposed the resolution with co-sponsors Supervisors David Campos, Malia Cohen, Jane Kim, Eric Mar, and Christina Olague. Amy Beinart and Stardust of Occupy Bernal wrote the original draft of the resolution.

Link: The Resolution As Passed

San Francisco Board of Supervisors Committee to Hear Foreclosure Moratorium

OCCUPY BERNAL AND OCCUPY SF HOUSING MEDIA ADVISORY

Contact: Christie Hakim, +1 (415) 285-6899, press@occupybernal.org

FOR IMMEDIATE RELEASE

Occupy Bernal, ACCE, and Occupy SF Housing Support Board of Supervisors’ First in the Nation Major City Resolution on Unlawful Foreclosures and Moratorium on Foreclosures and Evictions to be heard in committee April 2, 2012

San Francisco, April 2, 2012 – Occupy Bernal, the Alliance of Californians for Community Empowerment (ACCE), and the Occupy SF Housing Coalition will speak out at the Land Use and Economic Development Committee of the San Francisco Board of Supervisors in support of resolutions calling for a moratorium on foreclosures and evictions in San Francisco, demanding an immediate moratorium on predatory bank evictions, fraudulent foreclosures, and foreclosure auctions by all city officials.

The organizations plan a rally on the Polk Street steps of City Hall at 1:30pm. Speakers at the rally include: San Francisco Supervisors John Avalos and David Campos, Occupy Bernal Foreclosure and Eviction Fighter Ross Rhodes and ACCE Foreclosure and Eviction Fighter Vivian Richardson.

After the rally, speakers and other moratorium supporters will attend the Committee meeting at City Hall to present testimony.

Members of several City Departments, including the Assessor-Recorder’s office and the Mayor’s office, will present testimony. A representative from State Attorney General Kamala Harris’s office is expected to attend to address her proposed foreclosure and eviction moratorium and Homeowners’ Bill of Rights currently pending in Sacramento. In addition, counselors who have been working with San Franciscans facing foreclosure and eviction will speak about remedies that will address proposed remedies to the problems their clients face. ACCE and Occupy organizers including FEFs will speak out about the problems they have faced in their attempts to save their homes from foreclosure by Wells Fargo Bank.

Occupy Bernal, ACCE, and the Occupy SF Housing coalition invite the press to hear from San Francisco residents as well as from officials of the City and County of San Francisco.

The recent deal between banks and the Attorneys General of 49 of 50 states is woefully inadequate and does little for the Californians hardest hit by the crisis era or earlier.

“We are fast losing residents from our communities – seniors, families, community leaders, city workers,” said ACCE Foreclosure Fighter Archbishop Franzo King. “The city must do all in its power to pause foreclosures and cease partnering with predatory banks so we can all hold the banks accountable for their crimes.”

“The banks have torn apart our communities and caused a financial and health crisis by unjustly foreclosing and evicting our neighbors from their homes,” commented Occupy Bernal organizer Christie Hakim. “We support those city officials who have joined with the state Attorney General in calling for an immediate halt to predatory and for-profit foreclosures and related auctions and evictions.”

An audit commissioned by San Francisco Assessor-Recorder Phil Ting on nearly 400 San Francisco foreclosures over the past three years reveals that “fully 84 percent of the foreclosure files contained at least one clear legal violation and more than 66 percent of the files contained multiple violations”. This report confirms what many have suspected and provides the evidence required for issuing a moratorium on all predatory or for-profit evictions, foreclosures, and foreclosure auctions.

Both Occupy Bernal and ACCE have recently held successful protests that occupied the home of Wells Fargo CEO John Stumpf on February 25, 2012, protested in front of Board of Directors member Lloyd Dean’s Dignity Health office on March 14, 2012, and shut down Wells Fargo headquarters on January 20, 2012 and Wells Fargo bank branches in the Bernal and Excelsior neighborhoods on January 5 and January 7 respectively.

To sign up for the Occupy Bernal press list and/or obtain photos and video of the actions, see http://www.occupybernal.org/press.

Organizations and Campaigns:

Occupy Bernal is a neighborhood-based Occupy currently focusing on preventing the banks from throwing our neighbors out of their homes. Web: http://www.occupybernal.org

Alliance of Californians for Community Empowerment (ACCE) is raising up the voices of low income, immigrant and working families across California. Web: http://www.calorganize.org

Occupy SF Housing is a coalition which includes OccupySF, SF Tenants Union, Housing Rights Committee of SF, Causa Justa :: Just Cause, Eviction Defense Collaborative, ACCE, Homes Not Jails, Occupy Bernal, and other community groups and individuals. The coalition came together to stop banks from evicting tenants and homeowners through foreclosures or through their partnerships with real estate speculators. Web: http://www.occupysfhousing.org

Occupy the Auctions/Evictions is a campaign to halt for-profit and predatory evictions, foreclosures, and foreclosure auctions in San Francisco and beyond. Web: http://www.occupytheauctions.org and http://www.occupyevictions.org

– 30 –

Occupy SF Housing and San Francisco Officials to Call for Foreclosure Moratorium 12:00 Noon, March 20, at City Hall

Links: Foreclosure Moratorium Resolution (as introduced) Photos of the event

Update: Foreclosure and Eviction Fighters and Supervisors spoke together at a press conference on City Hall Steps. Supervisor John Avalos introduced the Foreclosure Moratorium Resolution at the Board of Supervisors meeting as planned.

OCCUPY BERNAL MEDIA ADVISORY

FOR IMMEDIATE RELEASE

Contact:

Occupy Bernal: Julien Ball, +1 (415) 483-9138, press@occupybernal.org

ACCE: Erin Franey, +1 (503) 816-4593, efraney@calorganize.org

Occupy SF Housing: Stardust, +1 (415) 425-3936, stardust@willdoherty.org

Occupy Bernal, ACCE, Occupy SF Housing Demand San Francisco End Evictions, Foreclosures, and Foreclosure Auctions

San Francisco Officials to Speak on Unlawful Foreclosures, Moratorium Resolution

San Francisco, March 20, 2012 – Occupy Bernal, the Alliance of Californians for Community Empowerment (ACCE), and the Occupy SF Housing Coalition today take their demand for an immediate moratorium on predatory bank evictions, fraudulent foreclosures, and foreclosure auctions to city officials, some of whom plan to introduce a foreclosure moratorium resolution to the San Francisco Board of Supervisors.

Press Conference of Foreclosure/Eviction Fighters and City/County Officials:

12:00–12:30pm, Tuesday, March 20, at

City Hall Steps, 400 Van Ness Ave, San Francisco (foreclosure auction side)

Speakers at the press conference will include: San Francisco Supervisors John Avalos, David Campos, and Christina Olague, Occupy Bernal Foreclosure and Eviction Fighters (FEFs) Alberto del Rio and Ernesto Viscarra, ACCE FEF Monica Kenney, who recently successfully fought a Wells Fargo eviction, and Molly Martin, an organizer from Occupy Bernal.

After the press conference, Supervisor John Avalos and co-sponsors – Supervisors Campos, Olague, and Kim, and Board President Chiu – plan to introduce a resolution for a moratorium on foreclosures and related auctions and evictions to the Board of Supervisors meeting at 2:00pm at City Hall.

Occupy organizers and supportive Supervisors have invited other officials from the City and County of San Francisco, including Mayor Ed Lee, Assessor-Recorder Phil Ting, Sheriff Ross Mirkarimi, City Attorney Dennis Herrera, District Attorney George Gascón, and other members of the Board of Supervisors, to the press conference and to introduce legislation and policies that will prevent unlawful foreclosures and related auctions and evictions in San Francisco.

Occupy Bernal, ACCE, and other community organizations in the Occupy SF Housing Coalition are also announcing an Occupy the Auctions/Evictions direct action campaign to invite the 99% to halt the dozens of foreclosure auctions that take place on City Hall steps each weekday.

Occupy Bernal, ACCE, and the Occupy SF Housing coalition invite the press to hear from San Francisco residents as well as from officials of the City and County of San Francisco.

“I no longer want to worry about what to tell my children when I return home each night,” said Occupy Bernal Foreclosure Fighter Alberto del Rio. “We who face bank foreclosures and evictions just want a fair deal from the banks so our families can sleep soundly in our homes.”

“We are fast losing residents from our communities – seniors, families, community leaders, city workers,” said ACCE Foreclosure Fighter Archbishop Franzo King. “The city must do all in its power to pause foreclosures and cease partnering with predatory banks so we can all hold the banks accountable for their crimes.”

California Attorney General Kamala Harris on February 27, 2012, asked lending giants Fannie Mae and Freddie Mac to halt foreclosures statewide and for principal reductions for those facing foreclosure.

“The banks have torn apart our communities and caused a financial and health crisis by unjustly foreclosing and evicting our neighbors from their homes,” commented Occupy Bernal organizer Molly Martin. “We support those city officials who have joined with the state Attorney General in calling for an immediate halt to predatory and for-profit foreclosures and related auctions and evictions.”

An audit commissioned by San Francisco Assessor-Recorder Phil Ting on nearly 400 San Francisco foreclosures over the past three years reveals that “fully 84 percent of the foreclosure files contained at least one clear legal violation and more than 66 percent of the files contained multiple violations”. This report confirms what many have suspected and provides the evidence required for issuing a moratorium on all predatory or for-profit evictions, foreclosures, and foreclosure auctions until such time as the law violations mentioned in the report are resolved and mechanisms are put in place to prevent further bank abuses of homeowners and renters.

The recent deal between banks and the Attorneys General of 49 of 50 states is woefully inadequate and does little for the Californians hardest hit by the crisis. Foreclosures have cost the state $650 billion in lost home values, property taxes, and foreclosure-related costs, according to a report released last December by California Reinvestment Coalition (CRC) and the Alliance of Californians for Community Empowerment (ACCE). The top banks – Wells Fargo, Bank of America, JPMorgan Chase, Citigroup, and Ally Financial – pay only $18 billion in this sweetheart deal, which amounts to only $150 per foreclosure statewide. About 750,000 families will receive up to $2,000, a pittance compared with even the depressed value of their homes. The largest chunk – more than $12 billion – will in part go to pressure even more homeowners to sell their homes for less than what they owe, in real estate transactions called short sales that are nothing more than an easy way for banks to make money and save time evicting homeowners, while leaving more and more neighbors without homes. To summarize, the 1% are profiting off the economic distress of the 99% to finagle the largest land grab since the Depression era or earlier.

In a city that has seen 12,000 or more foreclosures in the past three years, Occupy Bernal started organizing in December 2011 to stop the evictions and foreclosures of our neighbors, joining a community of housing rights organizations who have long been fighting for tenant’s and home owners’ rights. In response to public protest in January 2012, Wells Fargo Bank postponed auctions of the Bernal homes of Washington and Maria Davila and the Alberto Del Rio family, but the bank also rescheduled the auctions. Despite meeting with six foreclosure fighters from the Bernal Heights neighborhood and another from Bayview-Hunters Point, Wells Fargo executives have refused to allow any to refinance their homes or modify their loans, and have continued plans to sell off their homes.

This press conference follows on successful protests that occupied the home of Wells Fargo CEO John Stumpf on February 25, 2012, and shut down Wells Fargo headquarters on January 20, 2012, and Wells Fargo bank branches in the Bernal and Excelsior neighborhoods on January 5 and January 7 respectively.

To sign up for the Occupy Bernal press list and/or obtain photos and video of the actions, see http://www.occupybernal.org/press

Organizations and Campaigns:

Occupy Bernal is a neighborhood-based Occupy currently focusing on preventing the banks from throwing our neighbors out of their homes. Web: http://www.occupybernal.org

Alliance of Californians for Community Empowerment (ACCE) is raising up the voices of low income, immigrant and working families across California. Web: http://www.calorganize.org

Occupy SF Housing is a coalition which includes OccupySF, SF Tenants Union, Housing Rights Committee of SF, Causa Justa :: Just Cause, Eviction Defense Collaborative, ACCE, Homes Not Jails, Occupy Bernal, and other community groups and individuals. The coalition came together to stop banks from evicting tenants and homeowners through foreclosures or through their partnerships with real estate speculators. Web: http://www.occupysfhousing.org

Occupy the Auctions/Evictions is a campaign to halt for-profit and predatory evictions, foreclosures, and foreclosure auctions in San Francisco and beyond. Web: http://www.occupytheauctions.org and http://www.occupyevictions.org

– 30 –